Community insurance always covers the structure of the commnuity building. But what is exluded and what does community cover? In this blog we will explain the exlucsions and things to ask your community president and board.

What does Community Insurance Cover?

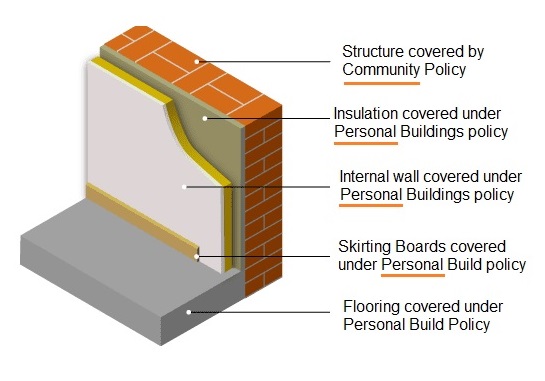

The main aspect of coverage with this insurance is the structure of the building and communal zones.

The second aspect that is always included is the liability for damages caused by the communities build and communal zones.

Does the Community Insurance cover water pipes?

The community policy will always cover pipes in the communal zones but not often does community insurance cover internal water pipes inside your property.

In our experience, only very few communities choose to cover the private water pipes inside each home. The reason is because it will increase the cost of the community insurance substantially.

Does the Community Insurance cover internal walls in your property and electrics?

This answer is very straightforward. The community insurance policy will never cover your internal walls and electrics within your home.

Electrics will include any electric cables inside your walls or wires from the wall that run to for example domestic appliances.

Therefore, it is very imortant you look to cover your internal building.

What are the limitations of cover for the Communities Liability?

The general areas will have liability such as by the swimming pool, hall ways, exteranl walls, and if I tile falls off the roof. However the communities insurance will not cover fire or water leaks from inside your home to other properties.

Options to include under your Private Home Insurance policy

What is covered if you have a private contents policy?

There is a common assumption that by having your contents covered you will have the liability included for your property. This is, in part true since the liability coverage for your “contents” damaging other properties is covered. This type of damage would be for example a plant pot or sun umbrella falling to the property below and causing damage.

It is important to point out however, that contents insurance will not cover the liability for damages to other properties caused by fire or water damages.

To have cover for fire and water damages you will need to insure some amount of buildings cover.

What buildings value should I insure if a community insurance is in place

There are two options to make sure your property is fully covered.

- The first option is to cover your building for its full rebuild value.

- The second and most common option is to cover the property for a percentage of the rebuild value. This type of cover is called “first loss” cover.

Only The Structure is covered under Community Insurance

What is first loss cover on the building?

For an average apartment, the value of first loss cover would be approximately 15,000 euros. The reason it is this figure is that if the damage or claim is over this amount it will usually be a structural problem. Another reason for this figure is that 95% of claims relating to personal buildings damages is below 15,000 euros.

How do I work out my properties full rebuild value?:

A common mistake that people make is thinking the value of the property is related to the purchase price of the property. This is not the case since the “rebuild” value does not take into account things such as: the view, location, and scarcity of property.

As mentioned previously the community insurance covers the stucture so only a percent of the full rebuild is needed to be insured. However ,we always recommend you insure the full rebuild, as your property will always be your largest invesment.

The rebuild value is based on the sq meters of the building. An insurance broker will be able to tell you this value and what the minimum rebuild value should be in your area relating to builder’s costs.